In order to establish a sound corporate governance structure and continuously raise corporate value, Canon Inc. believes that it is essential to improve management transparency and strengthen management supervising functions. At the same time, a sense of ethics and mission held by each executive and employee of a company is very important in order to achieve continuous corporate growth and development.

Canon Inc. (the “Company”) is globally expanding its businesses in various business fields, including printing, medical, imaging, and industrial and aims to aggressively expand into new business fields in the future. In order to make prompt decisions in each business field, and make important decisions for the entire Canon Group or matters that straddle several business fields from a company-wide perspective and at the same time secure appropriate decision making and execution of operation, the Canon Inc. judges the corporate governance structure below to be effective.

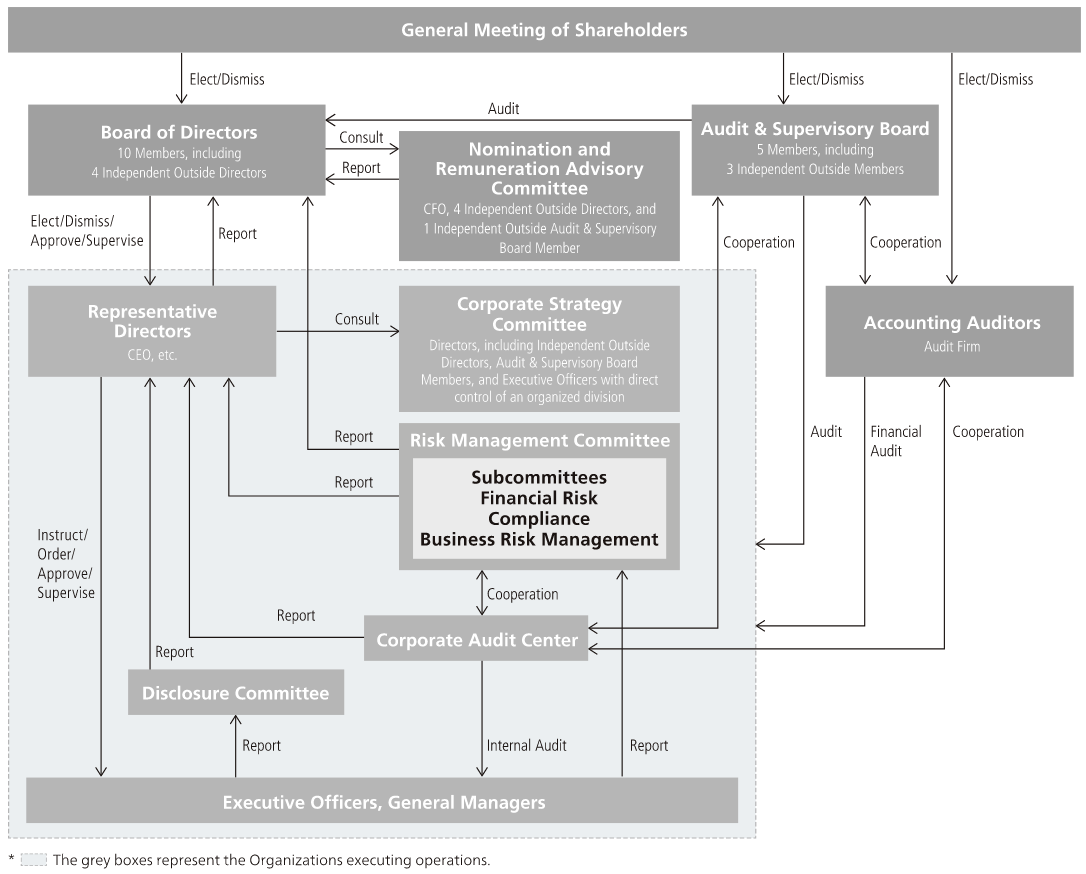

While the focus of the organizational structure of the Board of Directors is on Representative Directors that oversee company-wide business strategies or execution such as the CEO, COO, CFO, CTO, and Representative Directors or Executive Directors that oversee multiple business fields or headquarters functions, at least two Independent Outside Directors are appointed while also assuring that they account for one third or more of the total number of Directors, in order to secure sound management. The Board of Directors, in accordance with laws and regulations, makes important decisions and supervises the execution of duties by officers. Except for the above, the CEO and other Representative Directors are active in decision making and execution, and under the command and supervision of the Representative Directors, Executive Officers that are elected through resolution of the Board of Directors make decisions and execute operations of each business field or function. The Board of Directors consists of ten members, six Directors from inside Canon Inc. including three Representative Directors, and four Outside Directors that qualify as Independent Directors (including one female).

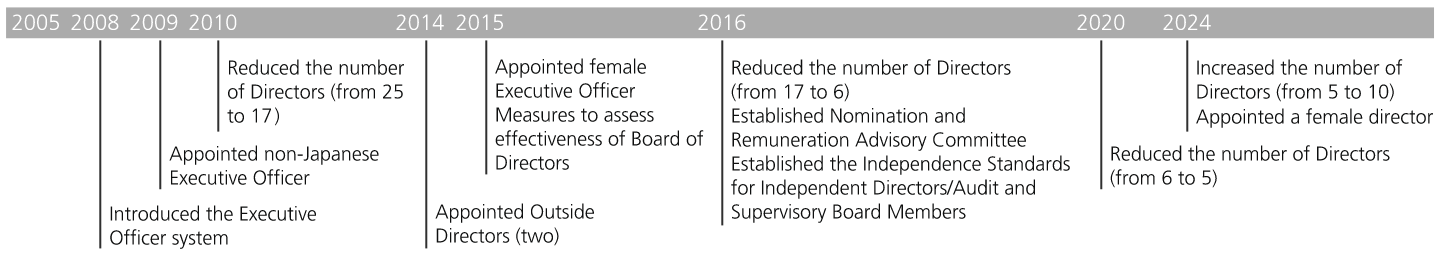

The Company gradually reduced the number of Directors from 25 when the Executive Officer system was introduced in 2008, with the aim of achieving prompt and flexible management. From 2021, the number of Directors was five, consisting of three Directors from inside the Company and two Outside Directors.

During this period, the Company has gradually increased the number of Executive Officers that are in charge of business execution. In 2024, it decided to strengthen the functions of the Board of Directors that oversees business execution by increasing the number of Directors, with the aim of strengthening the ability of the Board of Directors to respond to issues such as the changing business portfolio, expansion of business scope, and diversification of growth areas, in addition to enhancing the skills and development of the next generation of management.

For this purpose, the Company intends to promote new personnel who have made significant achievements in overseas business, advanced technology, and finance from inside the Company to Directors and strengthen the execution supervision function of the Board of Directors, with the most important criterion being that they have the ability and experience that match the required capabilities of the Board of Directors.

The Company’s business spans a wide range from B2B to B2C. In addition, the scope of management issues for the Board of Directors to consider is expanding to include issues such as SDGs, geopolitical risks, economic security, and cyber terrorism. The growing issues for the Board of Directors thus encompasses areas that cannot be examined adequately by personnel selected from inside the Company alone, and there is an increasing need to utilize the expertise of outside experts. To address this situation, the Company also plans to increase the number of Outside Directors who provide advice and supervision from an independent standpoint based on a medium- to long-term perspective. As a result, the number of Directors is ten, of which the four Outside Directors account for more than one third.

Managing in a volatile business environment, the Company intends to continue to review the appropriate structure and function of the Board of Directors, including its effectiveness, and adequately implement measures that meet the business environment and requirements for the board.

As a body which is in charge of the audit of operations, under the principles of autonomy, which is independent from the Board of Directors, Canon Inc. has full-time Audit & Supervisory Board Members that are familiar with Canon Inc.’s businesses or its management structure, and Independent Outside Audit & Supervisory Board Members that have extensive knowledge in specialized areas such as law, finance and accounting, and internal control. The Audit & Supervisory Board, which is composed of these individuals, cooperates with Canon Inc.’s Accounting Auditors and internal audit division, oversees the status of duty execution of operations and corporate assets to secure the soundness of management. There are five Audit & Supervisory Board Members of which three are Independent Outside Audit & Supervisory Board Members. In accordance with auditing policies and plans decided at Audit & Supervisory Board meetings, the Audit & Supervisory Board Members attend Board of Directors‘ meetings and other internal important gatherings such as Corporate Strategy Committee meetings. They are also able to listen to reports from Directors and employees, review documents related to important decisions, and conduct audits by investigating etc. the situation of businesses and property of Canon Inc. and its subsidiaries. Additionally, the Office of Audit & Supervisory Board Members is independent from the control of the Directors etc., and it has a dedicated staff. The Audit & Supervisory Board Members can order headquarter management and other operations to conduct investigations in cases of necessity. In this way, the Audit & Supervisory Board plays a role in monitoring management, conducting strict audits of Directors’ execution of duty, including the status of development of the internal control system. Furthermore, the Audit & Supervisory Board Members cooperate closely with the Accounting Auditors and Canon Inc.‘s internal auditing arm, and such cooperation services to improve each monitoring function.

Canon Inc. established the “Nomination and Remuneration Advisory Committee,” a non-statutory committee, which consists of the CFO, four Independent Outside Directors and one Independent Outside Audit & Supervisory Board Member. At the time, Director and Audit & Supervisory Board Member candidates are nominated and Executive Officers are appointed, including the selection of a successor for the chief executive officer position, the CEO recommends candidates thereof from among individuals that have been recognized as having met the prescribed requirements, and the Committee checks the fairness and validity of such recommendation prior to submission to and deliberation by the Board of Directors.

In particular, with regard to chief executive officer candidates, it is the CEO’s responsibility to select and train candidates through an executive training system and a mechanism for accumulating management experience, including the transfer of persons who have been selected as Executive Officers and involvement in company-wide projects. And the process is confirmed by the Nomination and Remuneration Advisory Committee.

Additionally, as for Audit & Supervisory Board Member candidates, prior to deliberation of the Board of Directors, consent of the Audit & Supervisory Board shall be acquired.

Canon Inc. established the Corporate Strategy Committee, consisting of Directors, including Independent Outside Directors, Audit & Supervisory Board Members, and some Executive Officers. Among items to be decided by the CEO, the Committee undertakes prior deliberations on important matters pertaining to Canon Group strategies.

Based on a resolution passed by the Board of Directors, Canon Inc. set up the Risk Management Committee, which formulates policy and action proposals regarding improvement of the Canon Group risk management system. The Risk Management Committee consists of three entities: the Financial Risk Management Subcommittee, which is tasked with improving systems to ensure reliability of financial reporting; the Compliance Subcommittee, which is tasked with promoting corporate ethics and improving legal compliance systems; and the Business Risk Management Subcommittee, which is charged with improving systems to manage overall business risks, including risks related to product quality and information leak. The Risk Management Committee verifies the risk management system’s improvement and implementation and reports the status to the CEO and the Board of Directors.

In addition, the Disclosure Committee was established to undertake deliberations pertaining to information disclosure, including content and timing, to ensure important corporate information will be disclosed in a timely and accurate manner.

Canon Inc. has established the Corporate Audit Center as its internal auditing division, which audits, evaluates, and makes recommendations on compliance and internal control systems etc. The Corporate Audit Center also conducts audits on topics such as quality, and health and safety. Audit results are reported not only to the CEO and CFO, but also to the Audit & Supervisory Board Members and the Audit & Supervisory Board as described in “Cooperation between Audit & Supervisory Board Members and Internal Auditing”. In addition, Canon Inc. has established a system in which reports are also regularly given to Outside Directors and those Outside Directors can request submission of proposals to the Board of Directors, as necessary.

Director and Audit & Supervisory Board Member candidates and Executive Officers are people that have the ability to fairly and effectively execute duties and, in principle, are selected from people that have met the following requirements, regardless of personal attributes such as gender, nationality, age etc.

| Representative Directors and Executive Directors | Have a true understanding of the corporate philosophy and code of conduct of the company. At the same time, have broad familiarity with the company’s businesses and operations, gained through, for example, Executive Officer experience. Have the ability to make effective decisions that overlook multiple businesses and functions. In addition to this, the CEO shall be a person with the ability to lead the Canon Group, having, in particular,a wealth of knowledge and skill related to management and a clear vision and a strong sense of responsibility. |

|---|---|

| Independent Outside Directors | In addition to meeting the independence standard that is separately determined by the Board of Directors, have an abundance of experience and superior insight into fields such as business management, risk management, law, and economics. |

| Audit & Supervisory Board Members | Be familiar with the company’s businesses or its management structure, or have an abundance of experience and superior insight into professional fields such as law, finance, accounting, and internal control. As for Outside Audit & Supervisory Board Members, additionally meet the independence standards that are separately determined by the Board of Directors. |

| Executive Officers | Have been highly evaluated in terms of character and ability in managerial assessment and managerial talent training programs, and also have sufficient knowledge, experience and judgment, to shoulder the responsibility of execution in specific fields, and truly understand the corporate philosophy and code of conduct of the company. |

In accordance with the philosophy of “kyosei,” the Company’s aim is to create new value through the power of technology and innovation toward realizing a better society, to provide world-first technologies and world-leading products and services, and to contribute to solving social issues.

With this in mind, we operate businesses in diverse fields with different market environments, from BtoB to BtoC, all over the world.

Given this background of the Company, in order for the Board of Directors to continue to make appropriate decisions and supervise business execution, and steadily achieve management goals, we believe that all members must share the philosophy of “kyosei,” and that the Board of Directors as a whole must cover at least the seven skills in the areas listed in the following table, including market and technological expertise in the Company’s business areas, management skills at a large company with a wide range of activities, a sophisticated international mindset, and advanced knowledge of ESG.

* The table below indicates up to five areas in which we expect each person to particularly demonstrate their skills. It does not represent the entirety of each person’s experience, knowledge, or skills.

| Directors | Skills to be Possessed by the Board of Directors Overall | ||||||

|---|---|---|---|---|---|---|---|

| Corporate Management | Global Understanding | Business Experience | Technology and Development | Finance and Accounting | Risk Management | ESG | |

| Skills as a senior level executive of a listed company that does business globally, and the like | Global awareness / experience obtained through working overseas, global marketing, etc. | Business management skills in the Company’s business domain | Knowledge and R&D experience in the Company’s core competence Technologies | Skills as a financial accounting expert, derived from being a financial accounting officer of a listed company, a certified public accountant, etc. | Skills as an expert in risk management, including compliance, and internal control systems | Knowledge and experience in ESG | |

| Fujio Mitarai | ● | ● | ● | ● | ● | ||

| Toshizo Tanaka | ● | ● | ● | ● | |||

| Toshio Homma | ● | ● | ● | ● | |||

| Kazuto Ogawa | ● | ● | ● | ● | |||

| Hiroaki Takeishi | ● | ● | ● | ● | |||

| Minoru Asada | ● | ● | ● | ● | |||

| Yusuke Kawamura | ● | ● | ● | ||||

| Masayuki Ikegami | ● | ● | |||||

| Masaki Suzuki | ● | ● | ● | ||||

| Akiko Ito | ● | ● | |||||

Canon Inc. established the “Independence Standards for Independent Directors/Audit and Supervisory Board Members,” resolved by the Board of Directors with the consent of all Audit and Supervisory Board Members, in order to clarify the standards for ensuring independence of Independent Directors / Audit and Supervisory Board Members of Canon Inc., taking into consideration Japan’s Corporate Governance Code (Principle 4.9) and the independence criteria set by securities exchanges in Japan. The standards are posted on Canon Inc.’s website. All of Canon Inc’s Outside Directors and Outside Audit & Supervisory Board Members satisfy the standards for independence, and assume roles that contribute to the maintenance and improvement of Board of Directors’ transparency and accountability. In addition, all of our Outside Directors and Outside Audit & Supervisory Board Members are registered as Independent Directors/Audit & Supervisory Board Members with the stock exchanges of Tokyo, Nagoya, Fukuoka and Sapporo in accordance with the requirements of the relevant stock exchange.

Canon Inc. deems that a person who satisfies the requirements for Outside Directors/Audit and Supervisory Board Members prescribed by the Corporation Law of Japan, and meets the independence criteria set by securities exchanges in Japan, and does not fall into any of the items below, is an “Independent Director/Audit and Supervisory Board Member” (a person who is independent from the management of Canon Inc. and unlikely to have conflicts of interest with general shareholders).

| Name | Reasons for Appointing | |

|---|---|---|

| Outside Directors | Yusuke Kawamura | Yusuke Kawamura has a wealth of experience as an Outside Director along with capacity as an expert with respect to financial and securities systems as well as strategy for managing financial institutions, given that he worked as a securities company and subsequently served in various positions, including as a university professor, a commissioner of councils of Japan’s Ministry of Finance and Financial Services Agency, and an Executive Counselor of the Japan Securities Dealers Association. Canon Inc. elected him as an Outside Director in hopes that he will furnish particularly useful advice, drawing on his wealth of experience and high level of expertise regarding finance and securities, especially when taking part in discussions on M&A and ESG-related topics from a shareholder and investor perspective. |

| Masayuki Ikegami | Masayuki Ikegami has been involved in various matters, including corporate cases, in legal professions over many years, having served in important roles at the High Public Prosecutors Office in both Nagoya and Osaka and as a Justice of the Supreme Court for seven years. Canon Inc. elected him as an Outside Director in hopes that he can provide insightful opinions and supervision, particularly regarding internal control systems and corporate governance, including from the perspective of ensuring corporate compliance, based on his abundant experience and advanced knowledge. | |

| Masaki Suzuki | Masaki Suzuki worked for many years at the Ministry of Finance, before transferring to the Ministry of the Environment, where he held important positions such as Vice-Minister. After retiring from the ministry, he also served as the representative director of a private financial institution. Canon Inc. elected him as an Outside Director in hopes that he can provide insightful opinions particularly concerning the areas of corporate finance and environment, in addition to opinions and supervision based on his managerial experience at financial institutions which require a high degree of appropriateness and compliance. | |

| Akiko Ito | Akiko Ito joined the Ministry of Construction (currently the Ministry of Land, Infrastructure, Transport and Tourism) as a technical official, served as its first female director (Director of Housing Bureau), and was responsible for policies for regional revitalization, including human resource development and job and town development, before becoming Commissioner of the Consumer Affairs Agency. Since retiring from the Consumer Affairs Agency, she has continued to participate in research in related fields, while serving as the outside director of a corporation. Canon Inc. elected her as an Outside Director in hopes that she can provide insightful advice and supervision particularly from the perspective of clients and consumers, as well as advice related to the active promotion of diverse human resources. | |

| Outside Audit & Supervisory Board Members | Yutaka Tanaka | Yutaka Tanaka had for many years served as a judge in charge of civil cases, and subsequently has been engaging in corporate legal affairs as an attorney and as a law school professor. Canon Inc. elected him as an Outside Audit & Supervisory Board Member as it desires to leverage his considerable experience and high level of expert knowledge about legal affairs to further enhance Canon Inc.’s auditing system. |

| Hiroshi Yoshida | Hiroshi Yoshida has engaged in the practice of corporate accounting as a certified public accountant for many years. Canon Inc. elected him as an Outside Audit & Supervisory Board Member so that Canon Inc.’s management may utilize his wealth of experience and advanced expert knowledge related to corporate accounting in improving the appropriateness of audits. | |

| Koichi Kashimoto | Koichi Kashimoto has, over many years, been involved in business management of The Dai-ichi Life Insurance Company, Limited, has served as a supervisor of general affairs including legal affairs, and furthermore has extensive international experience. Canon Inc. elected him as an Outside Audit & Supervisory Board Member given expectations that he will utilize such knowledge and experience in performing audits encompassing the entire Group, including its overseas operations. |

Once a year, a questionnaire survey of Directors and Audit & Supervisory Board Members on the items below is conducted. Based on the result of the questionnaire survey, analysis and evaluations regarding the effectiveness of the entire Board of Directors are carried out at the Board of Directors’ meeting.

As for fiscal year 2023, it was determined that there was no problem with the effectiveness of the Board of Directors due to ongoing measures to stimulate deliberation. These measures include, providing Outside Directors and the Audit & Supervisory Board with prior explanations of meeting agendas, sharing management information with Outside Directors through their attendance of Corporate Strategy Committee and other meetings, and the periodical exchanging of opinions between Outside Directors and the Audit & Supervisory Board. This also reflects the proactive and useful comments made not only by Directors in charge of business execution, but also Outside Directors and Audit & Supervisory Board Members.

In the future as well, yearly analysis and evaluations will be continued, and an overview of the results will be disclosed. At the same time, when necessary, efforts will be made to, among others, improve the operation of the Board of Directors.

The remuneration of Representative Directors and Executive Directors consists of a basic remuneration, a bonus and stock-type compensation stock options as described below.

Basic remuneration consists of a fixed amount of monetary remuneration paid monthly as consideration for the performance of duties of Directors. The amount is prescribed according to each Director’s position and the degree to which the Director contributes in this role and the total remuneration amount is within the limit approved at the General Meeting of Shareholders. (Total remuneration amount here refers to the total basic remuneration of all Directors including Outside Directors.)

As a reward for Director service over a one-year term, Directors receive a bonus once a year for which “consolidated income before income taxes” is used as a financial indicator to measure the results of annual groupwide corporate activities. The total amount of the Director’s bonus is determined by multiplying such consolidated income with a given predetermined coefficient that corresponds with the Director’s position. It is also determined through individual assessment based on the degree to which the Director contributes in this role.

Matters including whether a payment is allowed or the total amount of bonus as calculated above, are deliberated during the General Meeting of Shareholders every year.

Once a year, stock acquisition rights on Canon Inc.’s shares are granted with the intent of providing an incentive for Directors to further contribute to the improvement of medium- and long-term performance and raising corporate value through sharing the benefits and risks of share price fluctuations with Canon Inc.’s shareholders. The total amount of the stock acquisition rights is within the amount approved at the General Meeting of Shareholders and the number of those stock acquisition rights granted is calculated based on the amount determined by the Director’s position, the consolidated income before income taxes in the previous year, as well as the degree to which the Director has contributed in this role (the amount of monetary compensation claims granted to Directors for the payment in exchange for the stock acquisition rights), and the stock price level at the time of grant. As remuneration is linked to the achievements throughout one’s term in office, Canon Inc. has a system in place that allows the exercising of acquisition rights at the time of retirement.

As for Outside Directors and Audit & Supervisory Board Members, remuneration is limited to the basic remuneration, which is a fixed amount, paid each month.

Canon Inc., with the aim of ensuring the transparency and objectivity of the remuneration decision-making process as well as the validity of the remuneration system, established the “Nomination and Remuneration Advisory Committee,” a non-statutory committee, which consists of the CFO, four Independent Outside Directors, and one Independent Outside Audit & Supervisory Board Member. The Committee, after examining the rationale of the remuneration system, including calculation standards of the basic remuneration, the bonus and the granting standards of stock-type compensation stock option plan, reports to the Board of Directors to the effect that the system is reasonable.

Decisions regarding the amount and content of remuneration (the amount of basic remuneration and bonus as well as the number of stock-type compensation stock options) of each Director is delegated to the CEO. However, the CEO must make decisions based on the prescribed criteria in accordance with the policy described above and, prior to making a decision, the CEO must present the proposal to the Nomination and Remuneration Advisory Committee for confirmation.

The total amount of Directors’ basic remuneration and stock-type compensation stock options is within the total remuneration (upper limit) that is approved by the shareholders’ meeting. As for the bonus for Directors, the payment is fixed provided that the proposal about such payment submitted at the ordinary general meeting of shareholders is approved.

Remuneration for individual Audit & Supervisory Board Members is determined through discussion among the Audit & Supervisory Board Members within the limit of the remuneration amount approved by the General Meeting of Shareholders.

| Category of Position | Number of Directors and Audit & Supervisory Board Members | Remuneration Amounts by Classification (millions of yen) |

Remuneration Amounts (millions of yen) |

||

|---|---|---|---|---|---|

| Basic Remuneration | Bonus | Stock-type Compensation Stock Option | |||

| Directors (excl. Outside Directors) | 3 | 607 | 326 | 72 | 1,005 |

| Outside Directors | 2 | 48 | - | - | 48 |

| Audit & Supervisory Board Members (excl. Outside Audit & Supervisory Board Members) | 3 | 43 | - | - | 43 |

| Outside Audit & Supervisory Board Members | 3 | 59 | - | - | 59 |

For Directors and Audit & Supervisory Board Members, when assuming their positions, training is carried out with the aim of thoroughly understanding their roles and responsibilities and securing necessary or useful knowledge for them to properly fulfill their duties. Also incumbent Directors and Audit & Supervisory Board Members can, at Canon Inc.’s expense, attend training courses held inside and outside the company. Furthermore, Outside Directors and Outside Audit & Supervisory Board Members, to familiarize them with the company’s business, are given opportunities, including attending important meetings such as meetings of the Corporate Strategy Committee, holding meetings with the person in charge of business divisions, and visiting operation sites as necessary.

To ensure the effectiveness of internal audits, the Audit & Supervisory Board Members and the Audit & Supervisory Board receive from the internal auditing division outlines of their internal audit plan before conducting each audit as well as reports about important auditing items. After the internal audit is conducted, the Audit & Supervisory Board Members and the Audit & Supervisory Board hear reports on all audit results and evaluations. Furthermore, close cooperation is being worked for through, for example, the exchanging of opinions and information as necessary.

Audit & Supervisory Board Members and the Audit and Supervisory Board, prior to the start of an audit, receive briefs from the Accounting Auditors which include an overview of the audit plan and an explanation of important audit matters, and confirms validity. Additionally, the Audit & Supervisory Board Members and the Audit & Supervisory Board, at least once a month, receive reports from the Accounting Auditors on such matters as the implementation of accounting audits, quarterly reviews, and internal control audits, as well as briefs on the results of audits prior to expressing their opinion. With regard to key audit matters, Audit & Supervisory Board Members and the Audit and Supervisory Board receive reports and exchange opinions on the implementation status of risk assessment procedures on a regular basis.

In addition to accompanying the Accounting Auditors to be present during actual inventory audits, Audit & Supervisory Board Members also hold meetings with the Accounting Auditors in charge of auditing major affiliated companies in an effort to keep track of the status of audits being conducted. As for the Accounting Auditors’ system for managing the quality of the audit, detailed explanations are received and information is requested as necessary to confirm the appropriateness of such. For the purpose of monitoring the independence of the Accounting Auditors, the Company has introduced a system in which the Audit & Supervisory Board pre-approves the contents of audit and non-audit service contracts and the amount of remuneration, including those of subsidiaries.

For sustainable growth and to help improve corporate value over a medium- to long-term perspective, Canon Inc. has constructive dialogue with shareholders through an Ordinary General Meeting of Shareholders, corporate strategy conferences, financial results conferences, and interviews with major institutional investors.

Investor Relations (IR), Shareholder Relations (SR), sustainability, and legal divisions, are responsible for working together and promoting dialogue. The Executive Vice President & CFO oversees the entire structure to promote dialogue.

For analysts and institutional investors, the CEO hosts an annual corporate strategy conference, and the CFO hosts quarterly financial results conferences. In addition, we continue to provide prompt and accurate disclosure of business conditions by posting materials on Canon Inc.’s website. Furthermore, we established an English IR website for overseas investors, disclosing the same information at the same time as in Japan.

Additionally, Canon Inc. provides opportunities to meet with executive officers, Outside Directors, Audit & Supervisory Board Members etc., as necessary, to engage in dialogue with analysts and institutional investors in Japan and overseas. For detail, see “An Overview of Corporate Governance at Canon Inc.”

As for the opinions or demands that are obtained through dialogue with shareholders, accordingly, the department in charge reports to the CFO and the CFO reports important ones to the CEO or the Board of Directors.