Corporate Governance

Approach/Promotion System

Fundamental Policy

In order to establish a sound corporate governance structure and continuously raise corporate value, Canon Inc. believes that it is essential to improve management transparency and strengthen management supervising functions. At the same time, a sense of ethics and mission held by each executive and employee of a company is very important in order to achieve continuous corporate growth and development.

An Overview of Corporate Governance at Canon Inc.

Governance Structure

Basic Views

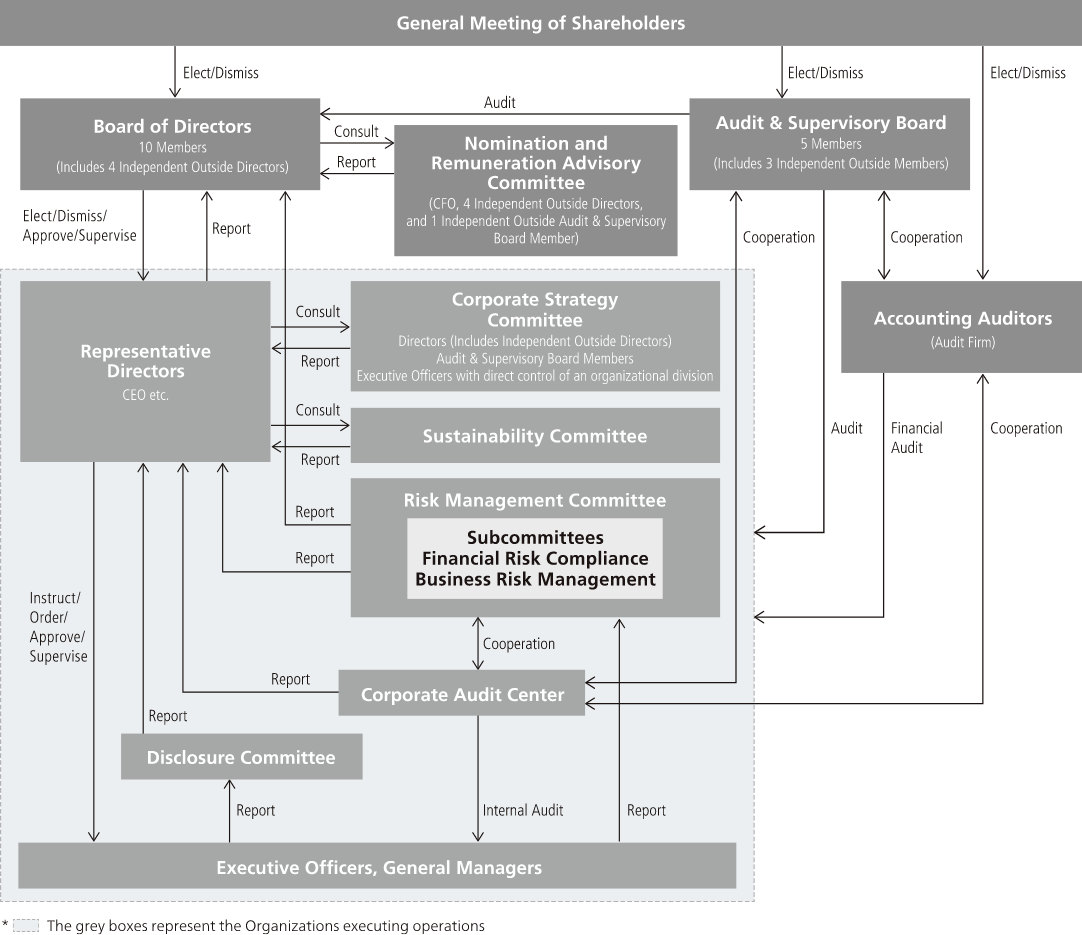

Canon Inc. is globally expanding its businesses in various business fields, including printing, medical, imaging, and industrial, and aims to aggressively expand into new business fields in the future. In order to make prompt decisions in each business field, and make important decisions for the entire Canon Group or matters that straddle several business fields from a company-wide perspective and at the same time secure appropriate decision making and execution of operation, Canon Inc. judges the corporate governance structure below to be effective.

| Year | Item |

|---|---|

| 2010 |

|

| 2014 |

|

| 2015 |

|

| 2016 |

|

| 2024 |

|

| 2025 |

|

Board of Directors

While the focus of the organizational structure of the Board of Directors is on Representative Directors that oversee company-wide business strategies or execution such as the CEO, COO, CFO, CTO, and Representative Directors or Executive Directors that oversee multiple business fields or headquarters functions, at least two Independent Outside Directors are appointed while also assuring that they account for one third or more of the total number of Directors, in order to secure sound management. The Board of Directors, in accordance with laws and regulations, makes important decisions and supervises the execution of duties. Except for the above, the CEO and other Representative Directors are active in decision making and execution, and under the command and supervision of the Representative Directors, Executive Officers that are elected through resolution of the Board of Directors make decisions and execute operations of each business field or function. The Board of Directors consists of ten members, six internal Directors including three Representative Directors and four Independent Outside Directors.

Audit & Supervisory Board

As a body which is in charge of the audit of operations, under the principles of autonomy, which is independent from the Board of Directors, Canon Inc. has full-time Audit & Supervisory Board Members that are familiar with Canon Inc.'s businesses or its management structure, and Independent Outside Audit & Supervisory Board Members that have extensive knowledge in specialized areas such as law, finance and accounting, and internal control. The Audit & Supervisory Board, which is composed of these individuals, cooperates with Canon Inc.'s Accounting Auditors and internal audit division, oversees the status of duty execution of operations and corporate assets to secure the soundness of management. There are five Audit & Supervisory Board Members of which three are Independent Outside Audit & Supervisory Board Members. In accordance with auditing policies and plans decided at Audit & Supervisory Board meetings, the Audit & Supervisory Board Members attend Board of Directors' meetings and other internal important gatherings such as Corporate Strategy Committee meetings. They are also able to listen to reports from Directors and employees, review documents related to important decisions, and conduct audits by investigating, etc., the situation of businesses and property of Canon Inc. and its subsidiaries. Additionally, the Office of Audit & Supervisory Board Members is independent from the control of the Directors, etc., and it has a dedicated staff. The Audit & Supervisory Board Members can order headquarters management and other operations to conduct investigations in cases of necessity. In this way, the Audit & Supervisory Board plays a role in monitoring management, conducting strict audits of Directors' execution of duty, including the status of development of the internal control system. Furthermore, the Audit & Supervisory Board Members cooperate closely with the Accounting Auditors and Canon Inc.'s internal auditing arm, and such cooperation services to improve each monitoring function.

Nomination and Remuneration Advisory Committee

Canon Inc. established the "Nomination and Remuneration Advisory Committee," a non-statutory committee, which consists of the CFO, four Independent Outside Directors and one Independent Outside Audit & Supervisory Board Member. With regard to the nomination of candidates for Directors and Audit & Supervisory Board Members and the election of Executive Officers (including the selection of a successor to the chief executive officer position), the CEO recommends candidates from among those who are recognized to meet predetermined requirements, and after confirming the fairness and appropriateness of the recommendation by the Nomination and Remuneration Advisory Committee, the proposal of candidates is submitted to the Board of Directors for deliberation.

In particular, Canon Inc. regards the succession planning for the CEO as one of the key themes that will lead to sustainable growth and medium- to long-term enhancement of corporate value. The CEO, under his own responsibility, assigns tasks to candidates, checks and evaluates the progress, and selects and develops candidates, through a training system for senior management, training programs for selected Executive Officers, a system for accumulating management experience through the transfer of persons who have been selected as Executive Officers and involvement in company-wide projects. And the process is confirmed by the Nomination and Remuneration Advisory Committee.

Additionally, as for Audit & Supervisory Board Member candidates, prior to deliberation of the Board of Directors, consent of the Audit & Supervisory Board shall be acquired. With the aim of ensuring the transparency and objectivity of the remuneration decision-making process as well as the validity of the remuneration system, the Committee, after examining the rationale of the remuneration system, including calculation standards of the basic remuneration, the bonus and the granting standards of stock-type compensation stock option plan, reports to the Board of Directors to the effect that the system is reasonable.

Corporate Strategy Committee

Canon Inc. established the Corporate Strategy Committee, consisting of Directors, including Independent Outside Directors, Audit & Supervisory Board Members, and some Executive Officers. Among items to be decided by the CEO, the Committee undertakes prior deliberations on important matters pertaining to Canon Group strategies.

Sustainability Committee

On April 1, 2024, Canon established the Sustainability Committee to share information and conduct preliminary deliberations with the aim of ensuring appropriate and effective judgment by the CEO or Board of Directors regarding the sustainability-related matters that the Canon Group should respond to or address.

Risk Management Committee

Based on a resolution passed by the Board of Directors, Canon Inc. set up the Risk Management Committee, which formulates policy and action proposals regarding improvement of the Canon Group risk management system. The Risk Management Committee consists of three entities: the Financial Risk Management Subcommittee, which is tasked with improving systems to ensure reliability of financial reporting; the Compliance Subcommittee, which is tasked with promoting corporate ethics and improving legal compliance systems; and the Business Risk Management Subcommittee, which is charged with managing risks to business management. The Risk Management Committee verifies the risk management system's improvement and implementation and reports the status to the CEO and the Board of Directors.

Disclosure Committee

The Disclosure Committee was established to undertake deliberations pertaining to information disclosure, including content and timing, to ensure important corporate information will be disclosed in a timely and accurate manner.

Corporate Audit Center (Internal Audit Division)

Canon Inc. has established the Corporate Audit Center as its internal auditing division, which audits each division and subsidiary of Canon Inc. on overall operations and management as well as on various topics such as finance, procurement, asset management, contracts, health and safety, quality, etc., and makes recommendations for improvements as necessary. Audit results are reported not only to the CEO and CFO, but also to the Audit & Supervisory Board Members and the Audit & Supervisory Board. In addition, Canon Inc. has established a system in which reports are also regularly given to Outside Directors and those Outside Directors can request submission of proposals to the Board of Directors, as necessary.

Attendance at Meetings of Board of Directors, Nomination and Remuneration Advisory Committee and Audit & Supervisory Board (Jan–Dec 2024)

| Directors/Audit & Supervisory Board Members | Attendance | |||

|---|---|---|---|---|

| Board of Directors | Nomination and Remuneration Advisory Committee | Audit & Supervisory Board | ||

| Directors | Fujio Mitarai | (10/10) 100% | — | — |

| Toshizo Tanaka | (10/10) 100% | (4/4) 100% | — | |

| Toshio Homma | (10/10) 100% | — | — | |

| Kazuto Ogawa | (7/7) 100% | — | — | |

| Hiroaki Takeishi | (7/7) 100% | — | — | |

| Minoru Asada | (7/7) 100% | — | — | |

| Outside Directors | Yusuke Kawamura | (3/3) 100% | (2/2) 100% | — |

| Kunitaro Saida | (10/10) 100% | (4/4) 100% | — | |

| Masayuki Ikegami | (7/7) 100% | (2/2) 100% | — | |

| Masaki Suzuki | (7/7) 100% | (2/2) 100% | — | |

| Akiko Ito | (7/7) 100% | (2/2) 100% | — | |

| Audit & Supervisory Board Members | Chikahiro Okayama | — | — | (15/15) 100% |

| Hideya Hatamochi | — | — | (21/21) 100% | |

| Katsuhito Yanagibashi | — | — | (6/6) 100% | |

| Outside Audit & Supervisory Board Members | Yutaka Tanaka | — | (4/4) 100% | (21/21) 100% |

| Hiroshi Yoshida | — | — | (21/21) 100% | |

| Koichi Kashimoto | — | — | (21/21) 100% | |

- * Kunitaro Saida and Katsuhito Yanagibashi retired effective March 28, 2024.

Board of Directors Structure

Board Policies in the Appointment of Senior Management and the Nomination of Director and Candidates

Director and Audit & Supervisory Board Member candidates and Executive Officers are people that have the ability to fairly and effectively execute duties and, in principle, are selected from people that have met the following requirements, regardless of personal attributes such as gender, nationality, age, etc.

Requirements of Director Candidates

| Representative Directors and Executive Directors |

Have a true understanding of the corporate philosophy and code of conduct of Canon Inc. At the same time, have broad familiarity with Canon Inc.'s businesses and operations, gained through, for example, Executive Officer experience. Have the ability to make effective decisions that overlook multiple businesses and functions. In addition to this, the CEO shall be a person with the ability to lead the Canon Group, having, in particular,a wealth of knowledge and skill related to management and a clear vision and a strong sense of responsibility. |

|---|---|

| Independent Outside Directors | In addition to meeting the independence standard that is separately determined by the Board of Directors, have an abundance of experience and superior insight in areas that cannot be adequately covered by internally appointed Directors into fields such as risk management, law, and economics. |

Skills of Board of Directors

Canon Inc. operates businesses globally with very different market environments. As a whole, the Board of Directors, which oversees important decision-making and execution, needs to possess skills in the following seven areas.

- * The table below indicates up to five areas in which we expect each person to particularly demonstrate their skills. It does not represent the entirety of each person's experience, knowledge, or skills.

| Directors | Directors Skills to be Possessed by the Board of Directors Overall | ||||||

|---|---|---|---|---|---|---|---|

| Corporate Management | Global | Business Experience | Technology and Development | Finance and Accounting | Risk Management | ESG | |

| As a senior level executive of a listed company that does business globally, and the like Global awareness | Global mindset and experience obtained through working overseas, global marketing, etc. | Business management skills in Canon Inc.'s business domain | Knowledge and R&D experience in Canon Inc.'s core competence technologies | Skills as a financial accounting expert, derived from being a financial accounting officer of a listed company, a certified public accountant, etc. | Skills as an expert in risk management, including compliance, and internal control systems | Knowledge and experience in ESG | |

|

Fujio Mitarai |

● | ● | ● | ● | ● | ||

|

Toshizo Tanaka |

● | ● | ● | ● | |||

|

Toshio Homma |

● | ● | ● | ● | |||

|

Kazuto Ogawa |

● | ● | ● | ● | |||

|

Hiroaki Takeishi |

● | ● | ● | ● | |||

|

Minoru Asada |

● | ● | ● | ● | |||

|

Yusuke Kawamura* |

● | ● | ● | ||||

|

Masayuki Ikegami* |

● | ● | |||||

|

Masaki Suzuki* |

● | ● | ● | ||||

|

Akiko Ito* |

● | ● | |||||

- * Outside

Reasons for Appointment of Outside Directors

In accordance with the Corporate Governance Code of the Financial Instruments Exchange (Principle 4-9) and our "Independence Standards for Independent Directors/Audit and Supervisory Board Members," Canon Inc. appoints Outside Directors for the following reasons:

Independence Standards for Independent Directors/Audit and Supervisory Board Members of Canon Inc.

| Name | Reasons for Appointing | |

|---|---|---|

| Outside Directors | Yusuke Kawamura | Yusuke Kawamura has a wealth of experience as an Outside Director along with capacity as an expert with respect to financial and securities systems as well as strategy for managing financial institutions, given that he worked as a securities company and subsequently served in various positions, including as a university professor, a commissioner of councils of Japan's Ministry of Finance and Financial Services Agency, and an Executive Counselor of the Japan Securities Dealers Association. Canon Inc. elected him as an Outside Director in hopes that he will furnish particularly useful advice, drawing on his wealth of experience and high level of expertise regarding finance and securities, especially when taking part in discussions on M&A and ESG-related topics from a shareholder and investor perspective. |

| Masayuki Ikegami | Masayuki Ikegami has been involved in various matters, including corporate cases, in legal professions over many years, having served in important roles at the High Public Prosecutors Office in both Nagoya and Osaka and as a Justice of the Supreme Court for seven years. Canon Inc. has selected him as a candidate for Outside Director in hopes that he can provide insightful opinions and supervision, particularly regarding internal control systems and corporate governance, including from the perspective of ensuring corporate compliance, based on his abundant experience and advanced knowledge. | |

| Masaki Suzuki | Masaki Suzuki worked for many years at the Ministry of Finance, before transferring to the Ministry of the Environment, where he held important positions such as Vice-Minister. After retiring from the ministry, he also served as the representative director of a private financial institution. Canon Inc. has selected him as a candidate for Outside Director in hopes that he can provide insightful opinions particularly concerning the areas of corporate finance and environment, in addition to opinions and supervision based on his managerial experience at financial institutions which require a high degree of appropriateness and compliance. | |

| Akiko Ito | Akiko Ito joined the Ministry of Construction (currently the Ministry of Land, Infrastructure, Transport and Tourism) as a technical official, served as its first female Director (Director of Housing Bureau), and was responsible for policies for regional revitalization, including human resource development and job and town development, before becoming Commissioner of the Consumer Affairs Agency. Since retiring from the Consumer Affairs Agency, she has continued to participate in research in related fields, while serving as the Outside Director of a corporation. Canon Inc. has selected her as a candidate for Outside Director in hopes that she can provide insightful advice and supervision particularly from the perspective of clients and consumers, as well as advice related to the active promotion of diverse human resources. |

Analyzing and Evaluating the Effectiveness of the Board of Directors

Once a year, a questionnaire survey of Directors and Audit & Supervisory Board Members on the items below is conducted. Based on the result of the questionnaire survey, analysis and evaluations regarding the effectiveness of the entire Board of Directors are carried out at the Board of Directors' meeting.

- As for the operation of Board of Directors (including the appropriateness of when documents are distributed, how often meetings are held, and the time spend deliberating)

- As for the role (decision making and supervisory function) of the Board of Directors (including the appropriateness of agenda items and agenda criteria of the Board of Directors as well as appropriateness etc. of content that is reported.)

- As for the roles of Outside Directors and Audit & Supervisory Board Members (including the necessity of training etc. regarding the understanding of company affairs and corporate structure)

In fiscal 2024, the Board of Directors made continuous efforts to vitalize deliberations at the Board of Directors, such as providing advance explanations on proposals to Outside Directors and the Audit & Supervisory Board, sharing information on management through the attendance of Outside Directors at Corporate Strategy Meetings, etc., regular exchanges of opinions between Outside Directors and the Audit & Supervisory Board, individual explanations and exchanges of opinions on business strategies from each business division to Outside Directors and Audit & Supervisory Board Members, explanations and exchanges of opinions on specific initiatives from the division in charge of sustainability to Outside Directors and Audit & Supervisory Board Members, and providing opportunities for Outside Directors to visit business sites. As not only Directors in charge of business execution but also Outside Directors and Audit & Supervisory Board Members made positive and useful comments, the Board of Directors meeting held in February 2025 evaluated that there were no problems with the effectiveness of the Board of Directors.

In the future as well, yearly analysis and evaluations will be continued, and an overview of the results will be disclosed. At the same time, when necessary, efforts will be made to improve the running etc. of Board of Directors meetings.

Executive Compensation

The remuneration of Representative Directors and Executive Directors consists of a basic remuneration, a bonus and stock-type compensation stock options as described below.

<Basic Remuneration>

Basic remuneration consists of a fixed amount of monetary remuneration paid monthly as consideration for the performance of duties of Directors. The amount is prescribed according to each Director's position and the degree to which the Director contributes in this role and the total remuneration amount is within the limit approved at the General Meeting of Shareholders. (Total remuneration amount here refers to the total basic remuneration of all Directors including Outside Directors.)

<Bonus>

As a reward for Director service over a one-year term, Directors receive a bonus once a year for which "consolidated income before income taxes" is used as a financial indicator to measure the results of annual groupwide corporate activities. The total amount of the Director's bonus is determined by multiplying such consolidated income with a given predetermined coefficient that corresponds with the Director's position. It is also determined through individual assessment based on the degree to which the Director contributes in this role.

Matters including whether a payment is allowed or the total amount of bonus as calculated above, are deliberated during the General Meeting of Shareholders every year.

<Stock-type Compensation Stock Options>

Once a year, stock acquisition rights on Canon Inc.'s shares are granted with the intent of providing an incentive for Directors to further contribute to the improvement of medium- and long-term performance and raising corporate value through sharing the benefits and risks of share price fluctuations with Canon Inc.'s shareholders. The total amount of the stock acquisition rights is within the amount approved at the General Meeting of Shareholders and the number of those stock acquisition rights granted is calculated based on the amount determined by the Director's position, the consolidated income before income taxes in the previous year, as well as the degree to which the Director has contributed in this role (the amount of monetary compensation claims granted to Directors for the payment in exchange for the stock acquisition rights), and the stock price level at the time of grant. As remuneration is linked to the achievements throughout one's term in office, Canon Inc. has a system in place that allows the exercising of acquisition rights at the time of retirement.

As for Outside Directors and Audit & Supervisory Board Members, remuneration is limited to the basic remuneration, which is a fixed amount, paid each month.

Process for Determining Remuneration

Canon Inc., with the aim of ensuring the transparency and objectivity of the remuneration decision-making process as well as the validity of the remuneration system, established the "Nomination and Remuneration Advisory Committee," a non-statutory committee, which consists of the CFO, four Independent Outside Directors, and one Independent Outside Audit & Supervisory Board Member. The Committee, after examining the rationale of the remuneration system, including calculation standards of the basic remuneration, the bonus and the granting standards of stock-type compensation stock option plan, reports to the Board of Directors to the effect that the system is reasonable.

Decisions regarding the amount and content of remuneration (the amount of basic remuneration and bonus as well as the number of stock-type compensation stock options) of each Director is delegated to the CEO. However, the CEO must compile the proposals based on the prescribed criteria. For making a decision before the Board of Directors deliberates on the remuneration of Directors, the CEO must present the proposal to the Nomination and Remuneration Advisory Committee for confirmation.

The total amount of Directors' basic remuneration and stock-type compensation stock options is within the total remuneration (upper limit) that is approved by the shareholders' meeting. As for the bonus for Directors, the payment is fixed provided that the proposal about such payment submitted at the ordinary general meeting of shareholders is approved.

Remuneration for individual Audit & Supervisory Board Members is determined through discussion among the Audit & Supervisory Board Members within the limit of the remuneration amount approved by the General Meeting of Shareholders.