Risk Management

Approach/Promotion System

Basic Approach

At Canon, we recognize that to ensure proper operations and to continually improve corporate value, implementation and maintenance of a risk management system to deal with significant risks that the Group may face in business operations is vital.

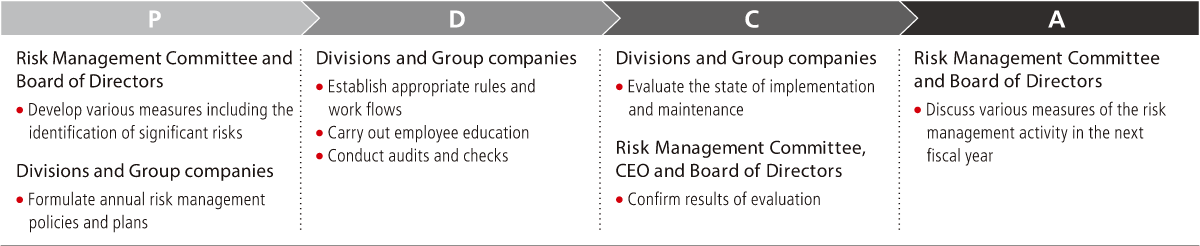

Risk Management System

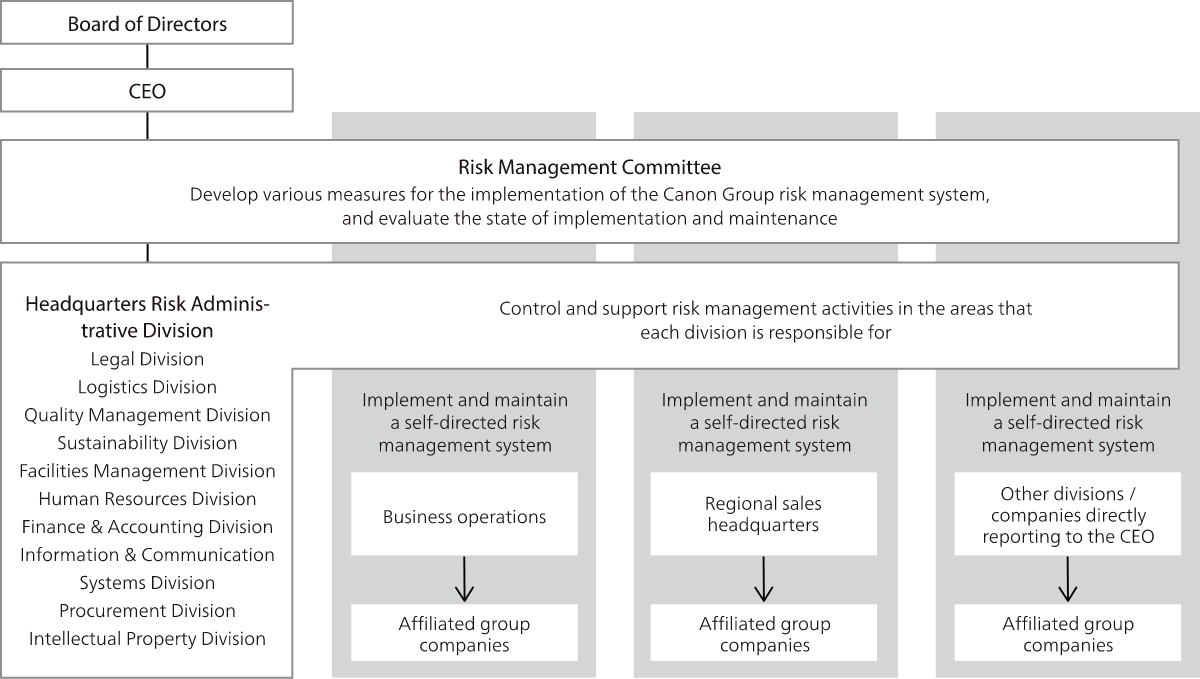

Canon Inc. has established a risk management committee based on a resolution of the Board of Directors. Chaired by the CFO, the committee has established three subcommittees: the Financial Risk Management Subcommittee, Compliance Subcommittee, and Business Risk Management Subcommittee.

The Risk Management Committee develops various measures to implement Canon's risk management system, including identifying any significant risks (violations of laws and regulations or corporate ethics, inappropriate financial reporting, environmental issues, quality issues or information leaks, etc.) that the Group may face in the course of business.

Canon Inc. administrative divisions responsible for various risks associated with business activities, including the Legal Division, Logistics Division, Quality Management Division, Human Resources Division, Finance & Accounting Division, belong to the relevant subcommittee and according to their areas of responsibility, control and support the risk management activities of each Canon Inc. division and Group company.

Under this system, each Canon Inc. division and Group company implements and maintains a self-directed risk management system and makes a yearly report to the Risk Management Committee on the results of its activities.

Having received the report of each subcommittee, division, and Group company, the Risk Management Committee evaluates the state of implementation and maintenance of the risk management system and reports its findings to the CEO and Board of Directors. The evaluation conducted in 2024 found no material flaws in the system.